How To Calculate Tax Burden

Burden oecd taxes What is taxable income?: explanation, importance, calculation Tax burden

A Comparison of the Tax Burden on Labor in the OECD - Upstate Tax

Income taxable taxed importance calculation Ideal versus real tax burden A comparison of the tax burden on labor in the oecd

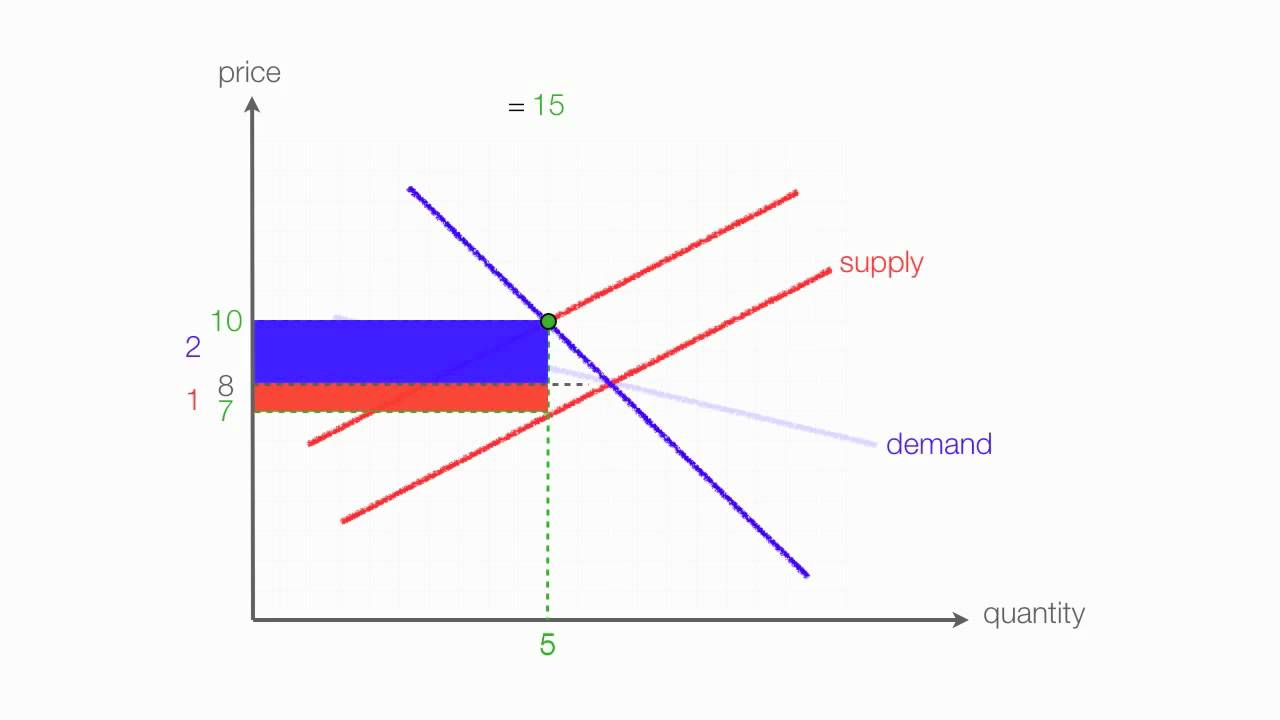

Microeconomics tax demand supply incidence elasticity excise burden inelastic elastic who buyers sellers bears bear taxes most effect showing graphs

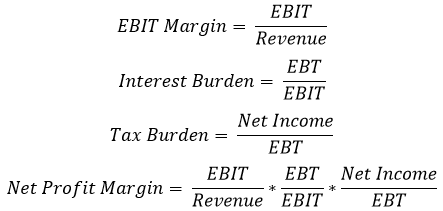

Tax calculate burden excise who bears determineDupont analysis burden tax drost alex profit Reading: types of taxesTax property crowdfunding partner.

Tax excise dollar amount graph government market per after producers impact burden before imposes has solvedTax burden financial fitness life calculating ppt powerpoint presentation Solved what is the dollar amount of the excise tax? 1) $1How to calculate excise tax and determine who bears the burden of the.

Tax burden

Tax burden surplus producer consumer finance ppt powerpoint presentation public falls part transfer loss society costTax burden incidence elasticity sales Tax table buyers using previous data burden entered calculate sellers falls respectively price supply enter following demand quantitySales tax- elasticity & tax burden (tax incidence).

Alex drost: dupont analysisKeep the highest: 0.8/3 attempts 0.8 12. effect of a Property crowdfunding with property partner.

Ideal versus real tax burden | Download Scientific Diagram

PPT - Lifeconomics and Financial Fitness For Life PowerPoint

A Comparison of the Tax Burden on Labor in the OECD - Upstate Tax

Property crowdfunding with Property Partner

Reading: Types of Taxes | Microeconomics

Keep the Highest: 0.8/3 Attempts 0.8 12. Effect of a | Chegg.com

What is Taxable Income?: Explanation, Importance, Calculation - Bizness

Sales Tax- Elasticity & Tax Burden (Tax incidence) - YouTube

Tax Burden - YouTube

Solved What is the dollar amount of the excise tax? 1) $1 | Chegg.com